Chasing Waterfalls in Iceland

Iceland is spectacular in so many ways and Icelandic nature is quite unique with its vast landscape, volcanic activity, geothermal areas, glacier lagoons and sceneries

Connect with local bloggers

Get all the essential travel information and tips for Iceland

Iceland is spectacular in so many ways and Icelandic nature is quite unique with its vast landscape, volcanic activity, geothermal areas, glacier lagoons and sceneries

In my search for turf houses around Iceland, I visited the lovely little turf house Sænautasel, which is a rebuilt turf house on Jökuldalsheiði heath in the highland of

Iceland’s striking landscapes are known for their stark beauty—volcanic deserts, lava fields, glaciers, and black sand beaches. Among these natural wonders, visitors in

The great thing about travelling around Iceland are all the different and unique spots and areas you can discover when driving around. You don't need to go far from the

The best time to capture the sunset at Kirkjufell mountain would be from the beginning of july and until the end of august. The scenery can be quite amazing as the sun

Did you know that Atlantic puffins spend most of their lives at sea, but return to land to form breeding colonies during spring and summer? Iceland is one of those colo

Don't give in even if the weather isn't playing perfectly along. Photographers coming to Iceland are often hoping to capture that perfect scene in perfect light. Those

Do you also like the smell in the geothermal areas of Iceland ?As you know Iceland is known for its geothermal activity. I guess most of us who live here are used to al

As winter slowly resides and releases its stronghold on Iceland I thought I’d share with you some pictures of winter in Iceland. This picture was taken on a tour which I

Get all the essential travel information and tips for Iceland

In this travel-blog, I want to show you the sights on Snæfjallastrandarvegur road number 635 in the Westfjords of Iceland. Here we will find the only fjord in Ísafjarðar

I love visiting waterfalls in Iceland, and I am especially fond of the so-called bridal veil waterfalls. I found one such waterfall hidden away up north on the Tjörnes

A beautiful Celtic stone cross has been erected at the outdoor altar at Esjuberg at Kjalarnes in southwest Iceland. Do you know why it was erected in this spot?Landnáma

In the southern part of Iceland, from Ölfus to Vík, you will find ancient caves that are very easily accessible. In this area, more than a hundred man-made caves have b

In this travel-blog I want to tell you about the Saga protagonist Gísli Súrsson, who was one of Iceland's best-known outlaws. Gísli's saga is told in Gísla saga Súrsson

In the beautiful Westfjords of Iceland, you will find many of Iceland's pearls of nature, some of which I have shown you in other travel-blogs. And in the many fjords in

In this travel-blog I want to show you the very scenic drive across Jökulháls mountain pass on the Snæfellsnes peninsula. This road, F-570, is only open for a couple of

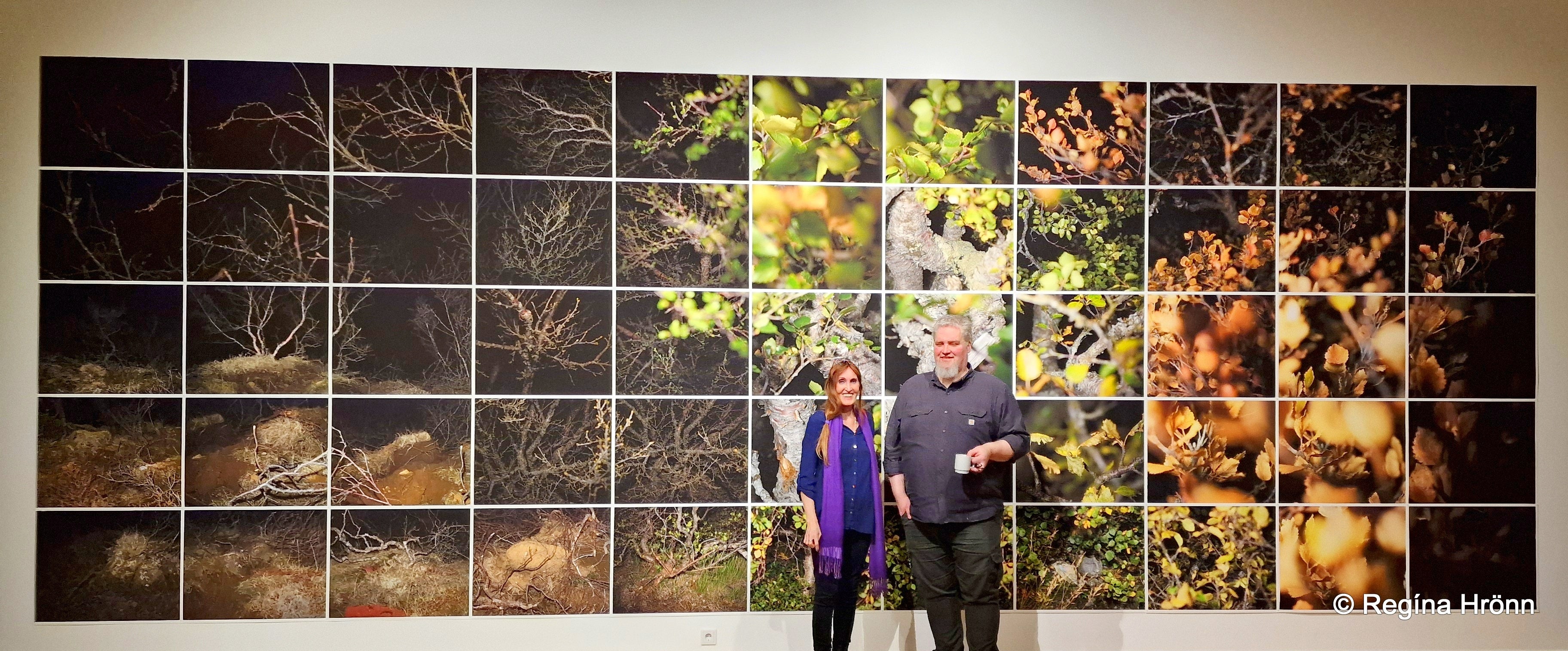

In this travel-blog I want to show you a photography exhibition by a brilliant photographic artist Pétur Thomsen. Pétur has held numerous photographic exhibitions in Ice

In this travel-blog I want to tell you about a multi-talented artist who lives in the Westfjords of Iceland, Marsibil Guðbjörg Kristjánsdóttir, nicknamed Billa. I got to

Explore all the places that you can visit in Iceland

Book an optimized itinerary for a perfect vacation in Iceland

Download Iceland’s biggest travel marketplace to your phone to manage your entire trip in one place

Scan this QR code with your phone camera and press the link that appears to add Iceland’s biggest travel marketplace into your pocket. Enter your phone number or email address to receive an SMS or email with the download link.